Health Equity/Social Determinants of Health

Session: Health Equity/Social Determinants of Health 5

271 - Expiration of the Expanded Child Tax Credit and Household Energy Insecurity: Unpaid Bills, Foregone Necessities and Unsafe Household Temperatures

Saturday, May 4, 2024

3:30 PM - 6:00 PM ET

Poster Number: 271

Publication Number: 271.1648

Publication Number: 271.1648

Cecile Yama, MD (she/her/hers)

Post Doctorate Fellow/ National Clinician Scholar

UCLA

Los Angeles, California, United States

Presenting Author(s)

Background: The 2021 expanded Child Tax Credit (ECTC) reduced poverty and food insecurity among households with children, however its impact on other social determinants of health, including energy insecurity, is unknown.

Objective: To measure associations between ECTC expiration and energy insecurity.

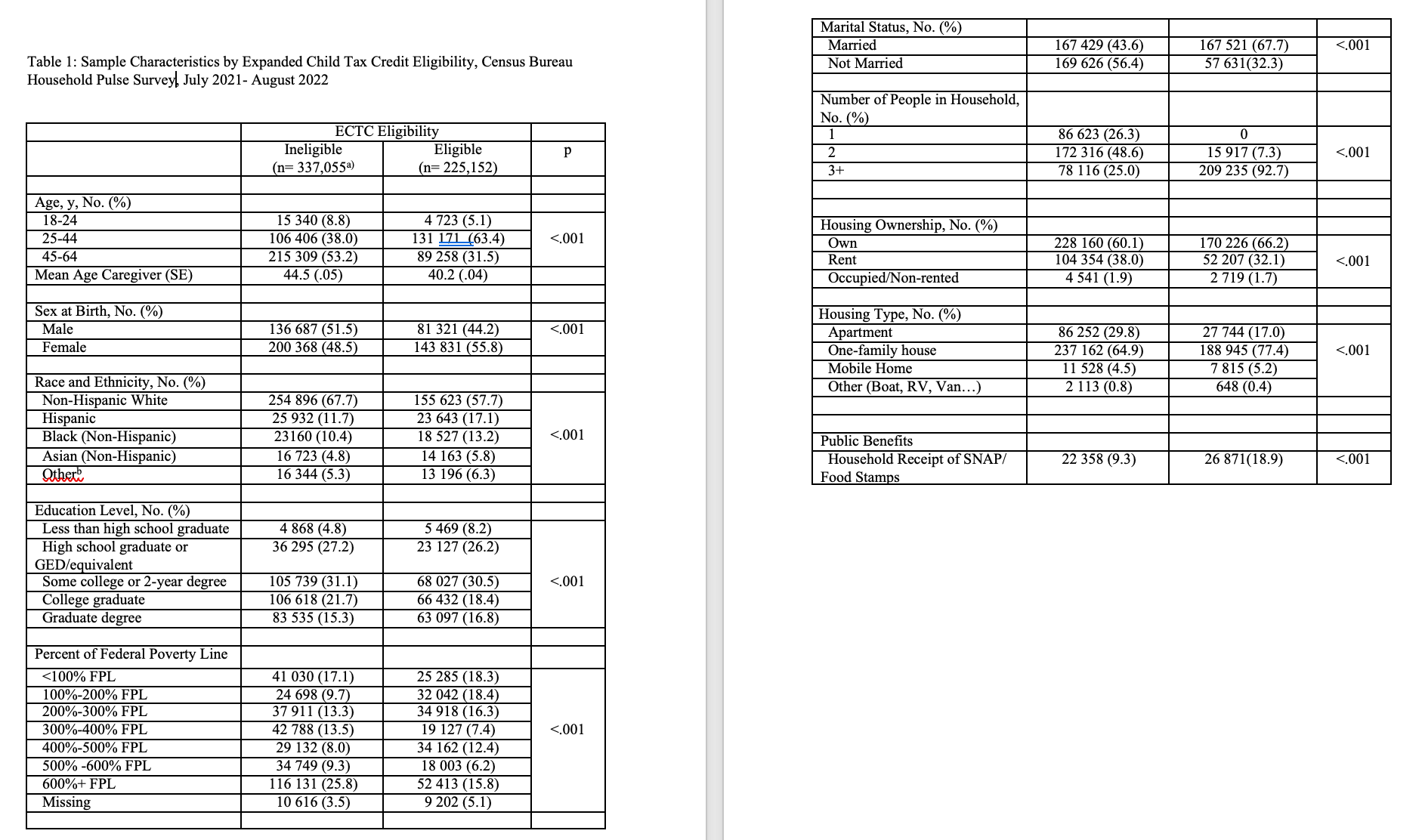

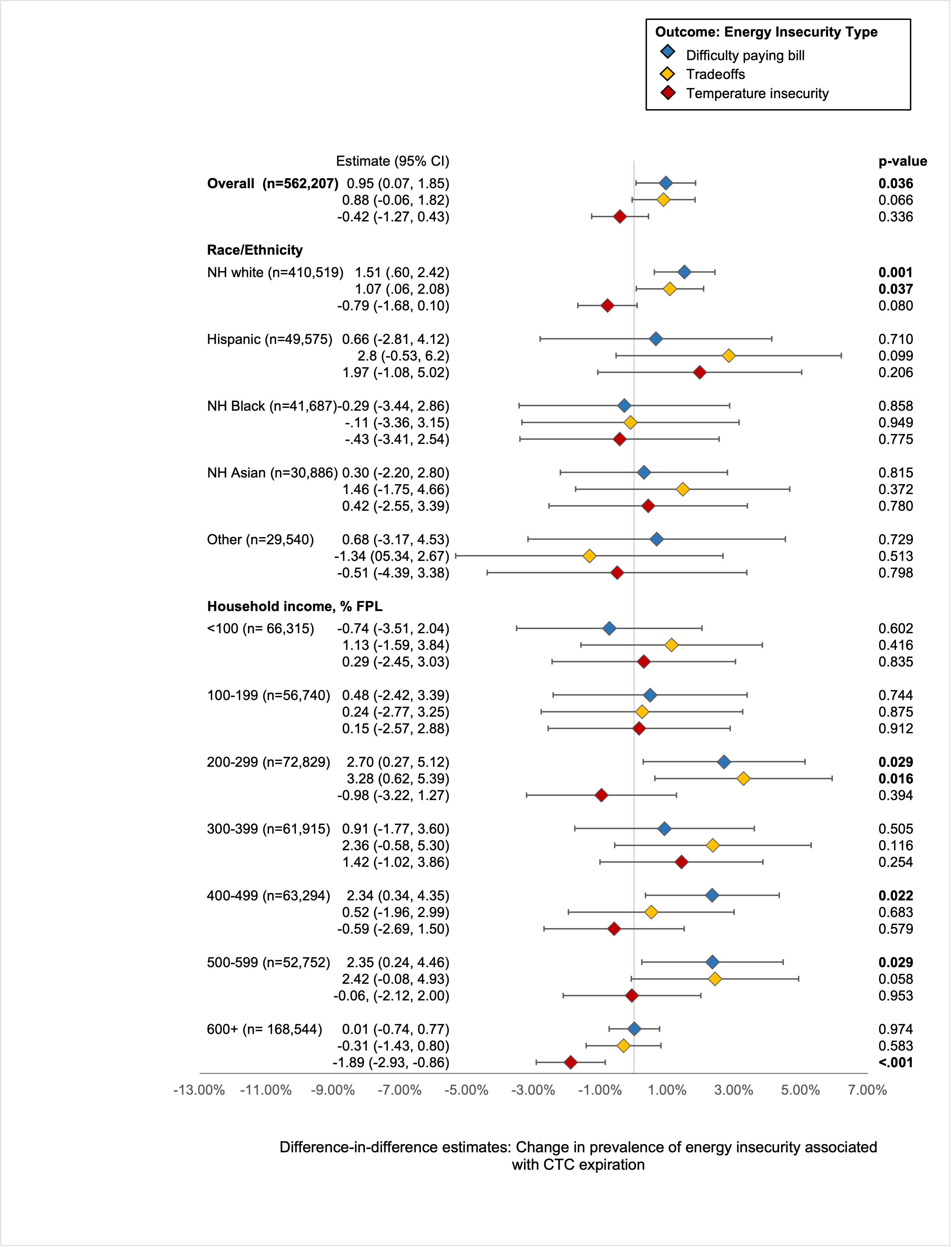

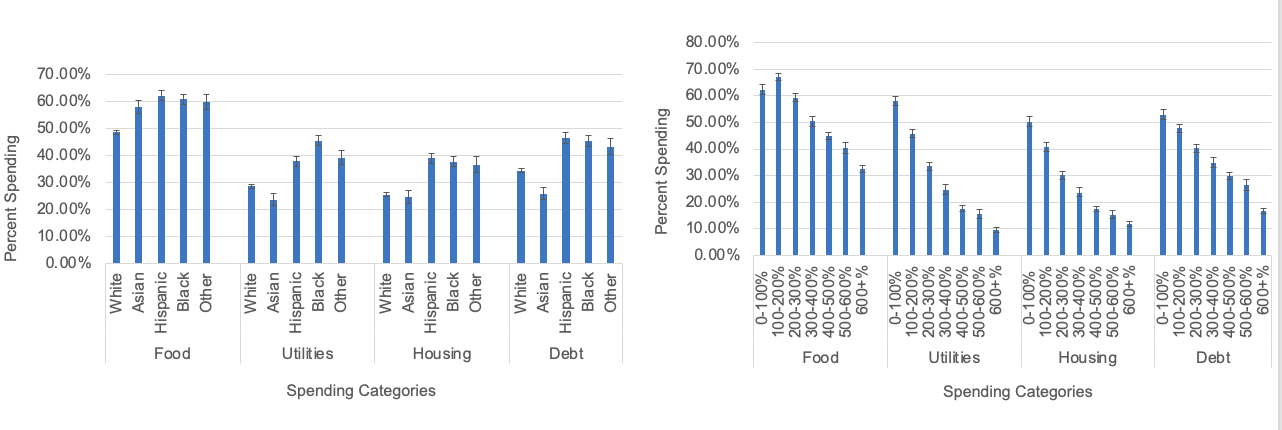

Design/Methods: In this quasi-experimental study, we measured associations between the ECTC and three measures of energy insecurity (inability to pay energy bills, having to forgo basic necessities, i.e. tradeoffs, and unsafe household temperatures) using repeated cross-sections from the nationally representative Household Pulse Survey (July 2021-August 2022). We compared characteristics of ECTC eligible and ineligible households, with eligibility proxied based on presence of children. Weighted, adjusted difference-in-difference models compared change in outcomes pre- vs. post-ECTC expiration between eligibility groups. We stratified analyses by respondent race or ethnicity and household poverty (percent of the federal poverty line, FPL) and later described ECTC spending patterns in a stratified subsample.

Results: Adults in ECTC eligible (vs. ineligible) households were more often younger, female, Black and Hispanic, lower income, and more likely to be homeowners (Table 1). In difference-in-differences analyses, ECTC expiration was associated with a 0.95 percentage-point (pp, 95% CI, 0.07-1.85) increase in difficulty paying energy bills (Figure 1). Among white respondents, expiration was associated with a 1.51 pp (95% CI, 0.60-2.42) increase in difficulty paying energy bills and a 1.07 pp (95% CI, 0.06-2.08) increase in tradeoffs. Among those at 200-299% FPL, expiration was associated with a 2.7 pp (95% CI, 0.3-5.1) increase in difficulty paying energy bills and a 3.3 pp (95% CI, 0.6-5.9) increase in tradeoffs. An increase of 2.34 pp and 2.35 pp in inability to pay energy bills was also seen among those at 400-499% of FPL (95% CI, 0.34-4.35) and 500-599% of the FPL (95% CI, 0.24-4.46), respectively. No other significant increases were found. Compared to Black and Hispanic households and lower income groups, white and middle-income households were less likely to report spending the ECTC on competing household needs (Figure 2).

Conclusion(s): The expiration of the ECTC was associated with increased difficulty paying energy bills, suggesting that the credit prevented energy insecurity in households with children. Associations were limited to white and low-to-middle-income groups. To prevent energy insecurity equitably, income supports must overcome competing needs among low-income, Black and Hispanic households.