Public Health & Prevention

Session: Public Health & Prevention 3

226 - Childhood Underinsurance During the COVID-19 Pandemic

Saturday, May 4, 2024

3:30 PM - 6:00 PM ET

Poster Number: 226

Publication Number: 226.1534

Publication Number: 226.1534

Caroline M. Goeller, Bachelors of Science (she/her/hers)

Medical Student

Wright State University Boonshoft School of Medicine

Beavercreek, Ohio, United States

Presenting Author(s)

Background: Access to health insurance plays a vital role in children's health. The significant disparity in children's health insurance affects their access to quality health care. Earlier work has found no effect of the Affordable Care Act on children's underinsurance status in southwestern Ohio. This study examines childhood underinsurance in southwestern Ohio during the COVID-19 pandemic.

Objective: To document the prevalence and correlates of children's underinsurance during the COVID-19 pandemic.

Design/Methods: This is a cross-sectional study of a convenience sample of children seen in primary care pediatric practices within the Southwestern Ohio Ambulatory Research Network. Primary caregivers (PCGs) were recruited in waiting rooms of participating practices from June 2021- April 2023. PCGs completed the Medical Expenses of Children Survey, which has been used in similar research since 2009. Index children were considered underinsured if their PCG responded "yes" to at least 1 of 6 questions regarding inability to pay for a pediatrician's recommendation despite the child having health insurance. PCGs with a child less than 18 years of age were eligible. Demographics included child’s insurance, PCG’s education, race, marital status, and household income. Comparisons between underinsured and adequately insured children were made with chi-squared tests and multiple logistic regression.

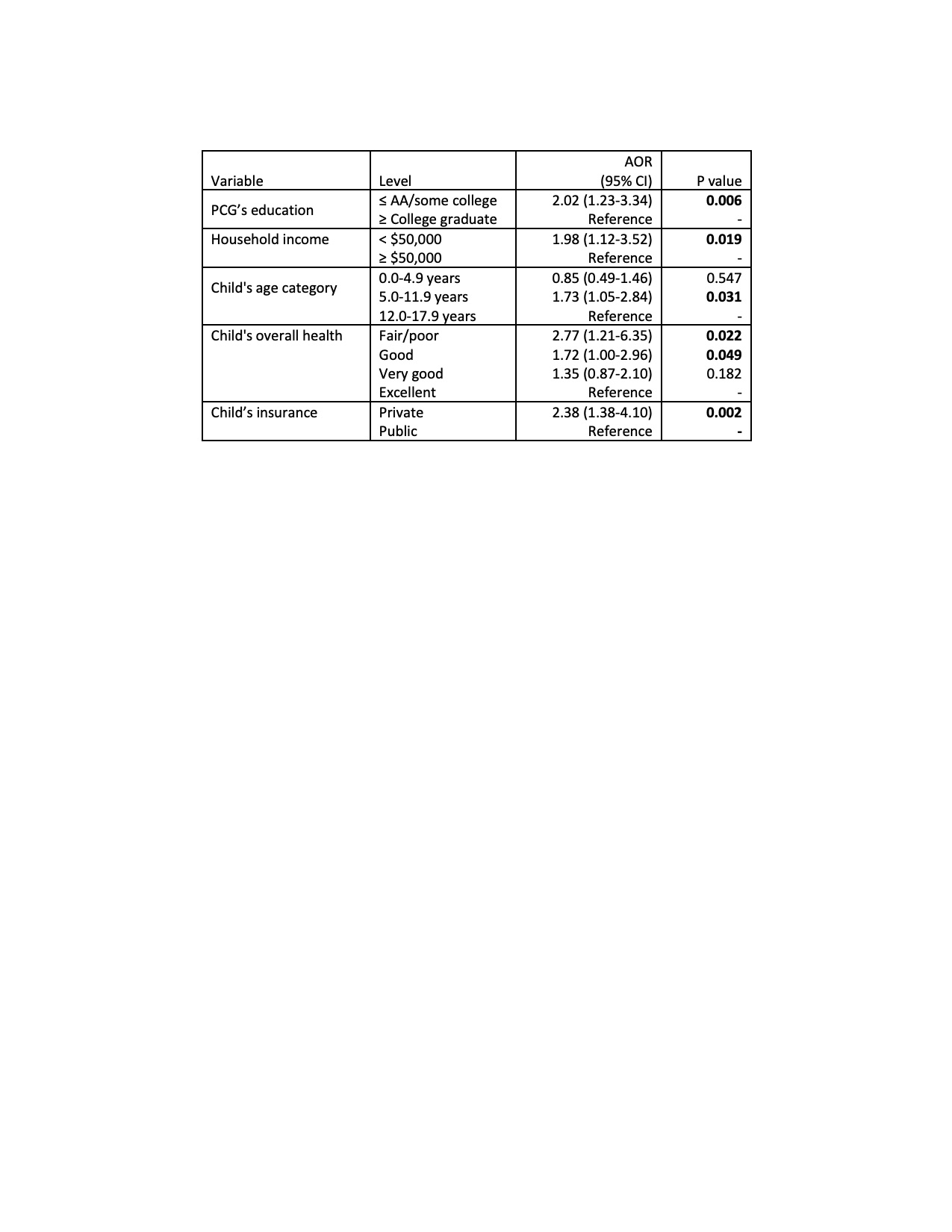

Results: Of the 1149 PCGs surveyed (86% response rate), 11% of children were underinsured, peaking at 16% for ages 5-11.9 years. 38% of PCGs of underinsured children found healthcare access harder at this time than three years prior versus only 9% of adequately insured children (P < 0.001). Private insurance is a risk factor for underinsurance, adjusted odds ratio= 2.4 (95% confidence interval, 1.4-4.1, reference group public insurance) (Table). 48% of PCGs with underinsured children reported that COVID-19 negatively impacted their child’s mental health versus 25% of adequately insured children (P < 0.001). 50% of PCGs of underinsured children reported that the COVID-19 pandemic negatively impacted their income compared to 27% of PCGs of adequately insured children (P < 0.001).

Conclusion(s): Private insurance is a risk factor for childhood underinsurance. The investigators speculate that this may be due, at least in part, to private insurance deductions and co-pays. Families raising underinsured children reported greater adverse effect of the pandemic on their child's mental health and their family's income. Future longitudinal research should examine long term and ongoing sequelae of the pandemic that may affect children's health.